"ttyymmnn" (ttyymmnn)

"ttyymmnn" (ttyymmnn)

01/24/2020 at 15:41 ē Filed to: taxlopnik

0

0

24

24

"ttyymmnn" (ttyymmnn)

"ttyymmnn" (ttyymmnn)

01/24/2020 at 15:41 ē Filed to: taxlopnik |  0 0

|  24 24 |

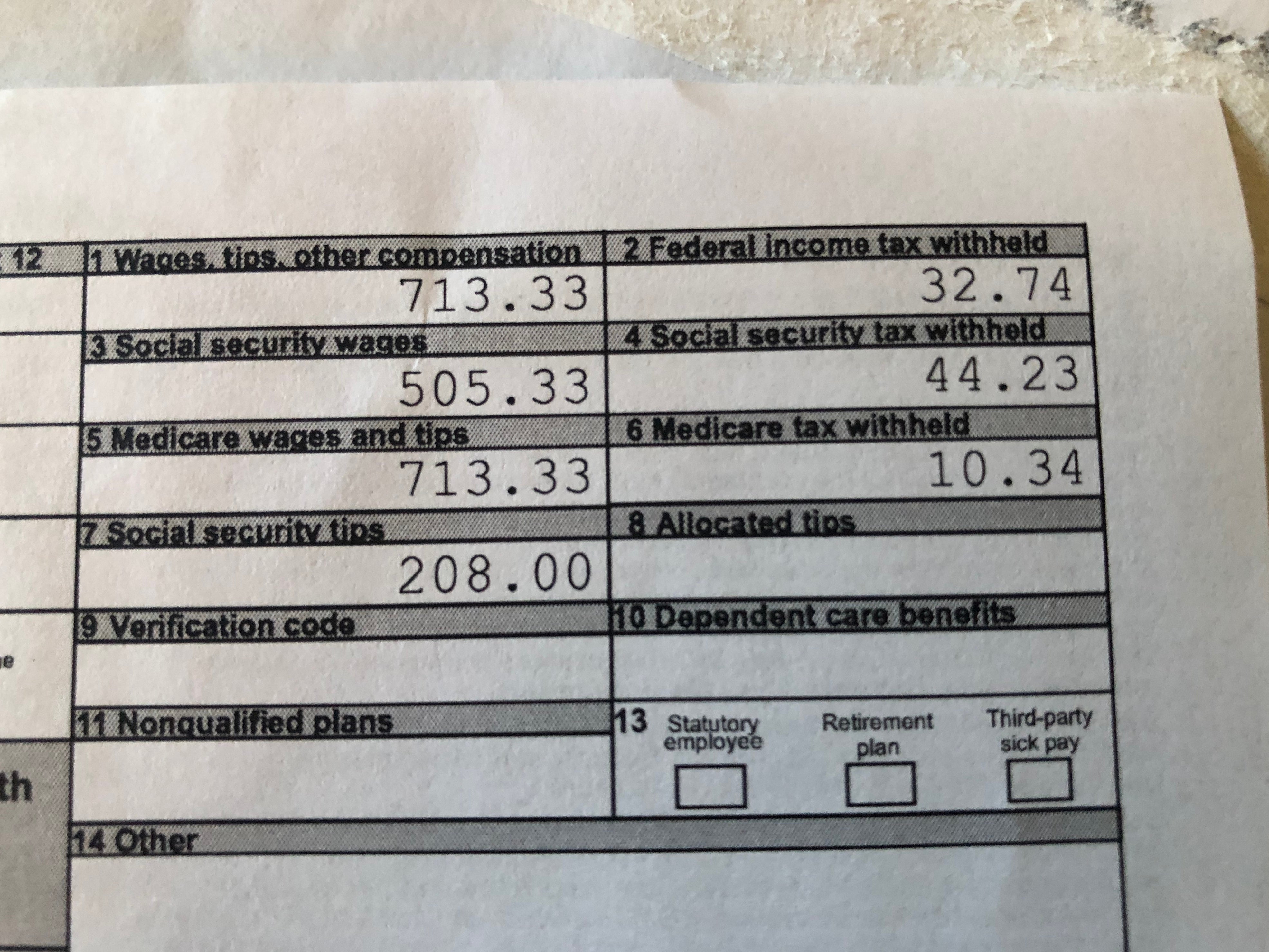

My son worked P/ T as a busboy at a neighborhood restaurant last summer. They sent him a W-2. Does he have to file?

TorqueToYield

> ttyymmnn

TorqueToYield

> ttyymmnn

01/24/2020 at 15:46 |

|

Seems like you donít need to file taxes if you make less than the standard deduction (about $12k)

Disclaimer: I am not an accountant - I do google things a lot.

lone_liberal

> ttyymmnn

lone_liberal

> ttyymmnn

01/24/2020 at 15:46 |

|

I donít think so. https://www.usatoday.com/story/money/2019/03/01/what-minimum-income-file-taxes-2019/3029811002/

But if he wants to be sure there is this tool https://www.irs.gov/help/ita/do-i-need-to-file-a-tax-return

jminer

> ttyymmnn

jminer

> ttyymmnn

01/24/2020 at 15:48 |

|

Before this last tax law change the answer was no to under $1k of earnings but I am not 100% sure on this anymore.

E90M3

> ttyymmnn

E90M3

> ttyymmnn

01/24/2020 at 15:49 |

|

I think TorqueToYield †might be right, but then you wouldnít get anything back assuming youíre owed a refund. Might only be $32 for the kid, but still a good idea to teach the kid how to do taxes.

shop-teacher

> ttyymmnn

shop-teacher

> ttyymmnn

01/24/2020 at 15:50 |

|

I donít think he has to, but I believe heíll get $85ish bucks back that was withheld if he does file.

ttyymmnn

> shop-teacher

ttyymmnn

> shop-teacher

01/24/2020 at 15:52 |

|

Well, that alone would make it worthwhile. Would take about 5 minutes to fill out an EZ.

Highlander-Datsuns are Forever

> ttyymmnn

Highlander-Datsuns are Forever

> ttyymmnn

01/24/2020 at 16:00 |

|

But if you are claiming him as a dependent he doesnít get a standard deduction right?

If only EssExTee could be so grossly incandescent

> ttyymmnn

If only EssExTee could be so grossly incandescent

> ttyymmnn

01/24/2020 at 16:01 |

|

My understanding is that †i f he files for a tax return , you canít claim him as a dependant.

Cť hť sin

> ttyymmnn

Cť hť sin

> ttyymmnn

01/24/2020 at 16:02 |

|

I do tax, just not your type!

ttyymmnn

> Highlander-Datsuns are Forever

ttyymmnn

> Highlander-Datsuns are Forever

01/24/2020 at 16:09 |

|

No idea. My wife does the taxes.†

ttyymmnn

> If only EssExTee could be so grossly incandescent

ttyymmnn

> If only EssExTee could be so grossly incandescent

01/24/2020 at 16:09 |

|

That makes sense.†

I like cars: Jim Spanfeller is one ugly motherfucker

> If only EssExTee could be so grossly incandescent

I like cars: Jim Spanfeller is one ugly motherfucker

> If only EssExTee could be so grossly incandescent

01/24/2020 at 16:12 |

|

I donít think so. My dad does taxes and though heís always claimed me as dependent, heís also always filed my taxes.

Heís also had witholdings taken which he is entitled to and will only get back if his taxes are filed.

jimz

> ttyymmnn

jimz

> ttyymmnn

01/24/2020 at 16:16 |

|

might as well get him started now.†

ttyymmnn

> jimz

ttyymmnn

> jimz

01/24/2020 at 16:18 |

|

Not if I have to drop him as a dependent.†

shop-teacher

> Highlander-Datsuns are Forever

shop-teacher

> Highlander-Datsuns are Forever

01/24/2020 at 16:18 |

|

He does not get the standard deduction, but I remember for years that I made under a few grand a year, while my parents were (rightly) claiming me as a dependent, I always got money back by filing.

jimz

> ttyymmnn

jimz

> ttyymmnn

01/24/2020 at 16:22 |

|

I donít think he pulled in nearly enough in order to prevent you from claiming him as a dependent.

diplodicus forgot his password

> ttyymmnn

diplodicus forgot his password

> ttyymmnn

01/24/2020 at 16:22 |

|

There hasnít been an ez form since 2017

facw

> If only EssExTee could be so grossly incandescent

facw

> If only EssExTee could be so grossly incandescent

01/24/2020 at 16:24 |

|

Pretty sure thatís not true. You list on your taxes if anyone can claim you as a dependent, which has implications for what you can claim.

facw

> ttyymmnn

facw

> ttyymmnn

01/24/2020 at 16:26 |

|

I always did taxes for my student jobs. May as well do them, or use this calculator thing: https://www.irs.gov/help/ita/do-i-need-to-file-a-tax-return

It will be good practice regardless.

ttyymmnn

> diplodicus forgot his password

ttyymmnn

> diplodicus forgot his password

01/24/2020 at 16:28 |

|

Like I said to somebody else, my wife does the taxes. I just stand there and rub her shoulders and keep her coffee cup full.†

ttyymmnn

> facw

ttyymmnn

> facw

01/24/2020 at 16:29 |

|

Would I lose him as a dependent?

facw

> ttyymmnn

facw

> ttyymmnn

01/24/2020 at 16:45 |

|

I think y ou should still be able to claim, as long as his filing says that someone can claim him as a dependent.

ITA97, now with more Jag @ opposite-lock.com

> ttyymmnn

ITA97, now with more Jag @ opposite-lock.com

> ttyymmnn

01/24/2020 at 17:53 |

|

His filing at this kind of income shouldnít impact you claiming him as a dependent. He probably doesnít have to file either, but he should. Both because heíll learn something and to get his $32 back. Thatís gas and beer †money, after all.

LastFirstMI is my name

> ttyymmnn

LastFirstMI is my name

> ttyymmnn

01/24/2020 at 22:31 |

|

Was he working as a busboy in Grand Cayman or Panama? Then- no, you donít need to pay taxes or follow any internationals laws for that matter.†